Just Released: 2024 Multifamily U.S. Investment Forecast

“Demand for Multifamily Housing Improving Amid Durable Economy, But Benefits Disguised by Ample New Supply”

Marcus & Millichap has publicly released the Annual Multifamily Investment Outlook Report, providing details on major trends that will dominate this upcoming year.

U.S. Multifamily Index

Overview:

The NMI ranks 50 major markets on a collection of 12-month, forward-looking economic indicators and supply and demand variables. Markets are ranked based on their cumulative weighted average scores for various indicators, including projected job growth, vacancy, construction, housing affordability, rents, historical price appreciation, and cap rate trends. Weighing the history, forecasts, and incremental change over the next year, the Index is designed to show relative supply and demand conditions at the market level.

Market conditions have allowed for substantial demographic and supply trends to positively impact the performance of the Phoenix market. Phoenix ranks #34 on our National Multifamily Index due to record construction instigating nationally-high vacancy in Phoenix which pulls its ranking into the lower half of the 2024 NMI.

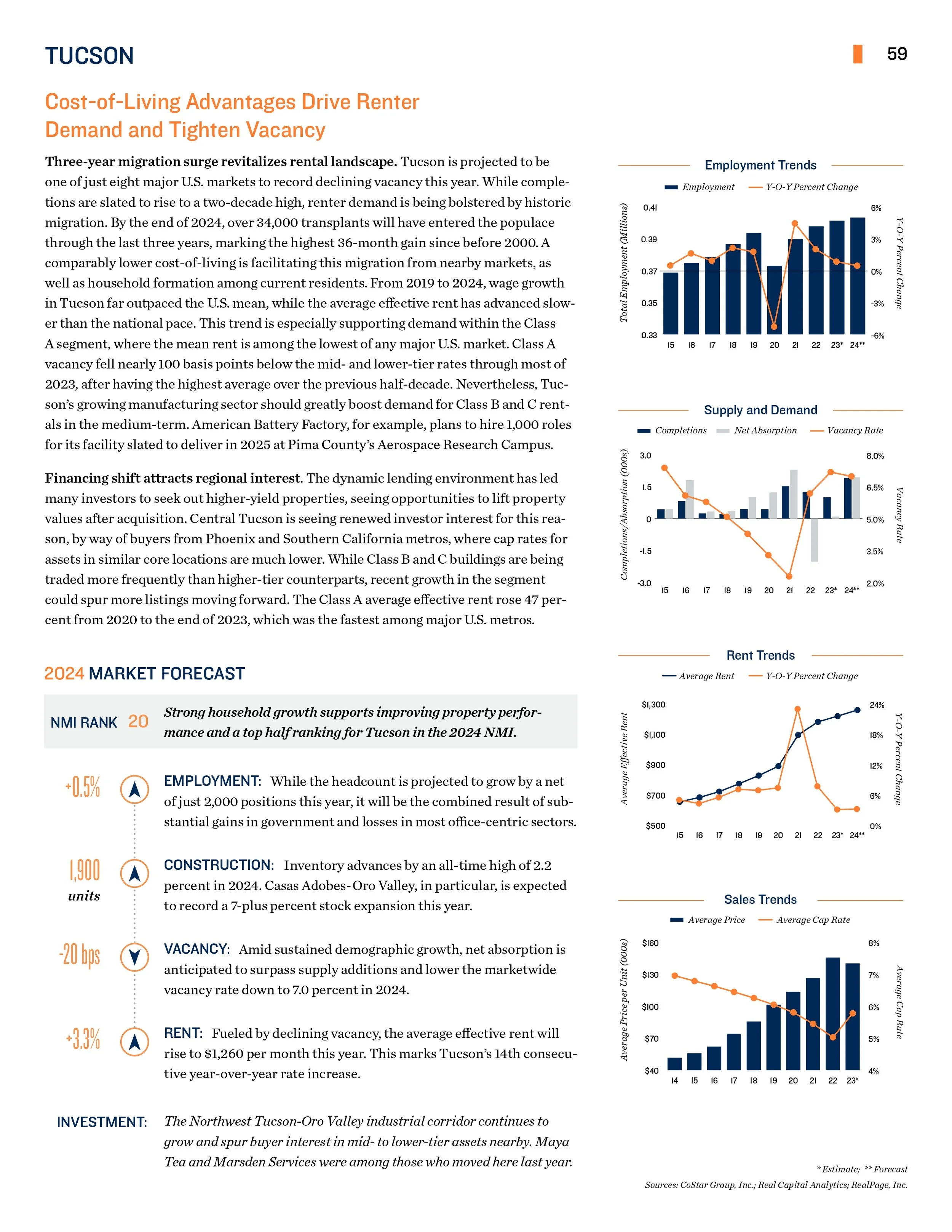

Driven by strong household growth supporting the improvement of property performance, the Tuscon market has been pushed towards a top-half ranking of #20 in the 2024 NMI.

Phoenix 2024 Market Forecast

Job growth: Steady yet subdued, adding 26,500 positions (down from the long-term average) but supporting healthy market activity with the new resident influx.

Construction: Booming, with the second-highest delivery volume among major US metros (13,000 units in key areas) pushing overall inventory to a record high (6.9% increase).

Vacancy: Expected to rise to 9.7% due to construction surge, but pockets with limited development (West Phoenix, South Tempe, North Glendale) may see more stability.

Rents: Anticipated to dip slightly to $1,575/month after a 1.6% decline in 2023, but still 33% higher than 2019, reflecting enduring market strength.

Affordability advantage: A magnet for budget-conscious renters priced out of nearby metros, fueling demand in areas like Avondale-Goodyear-West Glendale, Central Phoenix, and Gilbert.

Tucson 2024 Market Forecast

Employment: Modest net job growth of 2,000 positions, driven by gains in government but offset by losses in office-centric sectors.

Construction: Record inventory expansion of 2.2%, with Casas Adobes-Oro Valley experiencing a significant 7%+ stock increase.

Vacancy: Despite new construction, sustained demographic growth will drive net absorption and push the marketwide vacancy rate down to 7.0%, the lowest in years.

Rent: Rents expected to rise to $1,260 per month, marking the 14th consecutive year of year-over-year increases, fueled by declining vacancy.

Investment: Growing Northwest Tucson-Oro Valley industrial corridor attracting interest in mid- to lower-tier multifamily assets, with companies like Maya Tea and Marsden Services establishing a presence.

Source: "2024 U.S. Multifamily Investment Forecast" by John Sebree, Peter Standley, Evan Denner, & John Chang